how much of my paycheck goes to taxes in colorado

For 2022 the limit for 401 k plans is 20500. The final 25000 of your income would be taxed at 30 or 7500.

Every employer who is required to withhold Colorado income tax must apply for and maintain an active Colorado wage withholding account.

. If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541. How Your Paycheck Works. The amount withheld for federal taxes depends on the information youve filled out on.

If you make 70000 a year living in the region of Colorado USA you will be taxed 11001. Jul 26 2022 0255 PM MDT. The next 30000 would be taxed at 20 or 6000.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. FICA taxes go toward Social Security and Medicare. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. Calculate your tax year 2022 take home pay after federalstatelocal taxes deductions and exemptions. These tiers are if you file taxes as a single individual.

Colorado tax year starts from July 01 the year before to June 30 the current year. Each tax type has specific requirements regarding how you are able to pay your tax liability. Any income exceeding that amount will not be taxed.

For Glendale residents the tax rate is 5 a month if you earn at least 750. Use ADPs Colorado Paycheck Calculator to calculate net take home pay for either hourly or salary employment. And if youre in the construction business unemployment taxes are especially complicated.

You pay the tax on only the first 147000 of your earnings in 2022. In this scenario even though youre in the 30 bracket you would actually pay only about 207 of your income in taxes. To calculate your effective tax rate divide your total tax by your total income.

2000 6000 7500 15500. It changes on a yearly basis and is dependent on many things including wage and industry. Employers may apply for an account online at mybizcoloradogov or by preparing and submitting a Colorado Sales Tax and Withholding Account Application CR 0100AP.

Employers in Greenwood Village will take out 2 every month if you earn more than 250. 22 for 40525 - 86375 24 for 86436 - 164925 and so on. Colorado Income Tax Calculator 2021.

Our calculator has been specially developed in order to provide the users of the calculator with not only. In Sheridan youll be taxed 3 per month regardless of your wages. Sales Use Tax.

Figure out your filing status. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. This free easy to use payroll calculator will calculate your take home pay.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Married couples who file together or individuals who file as the head of a household will pay different paycheck taxes under brackets unique to their filing status. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

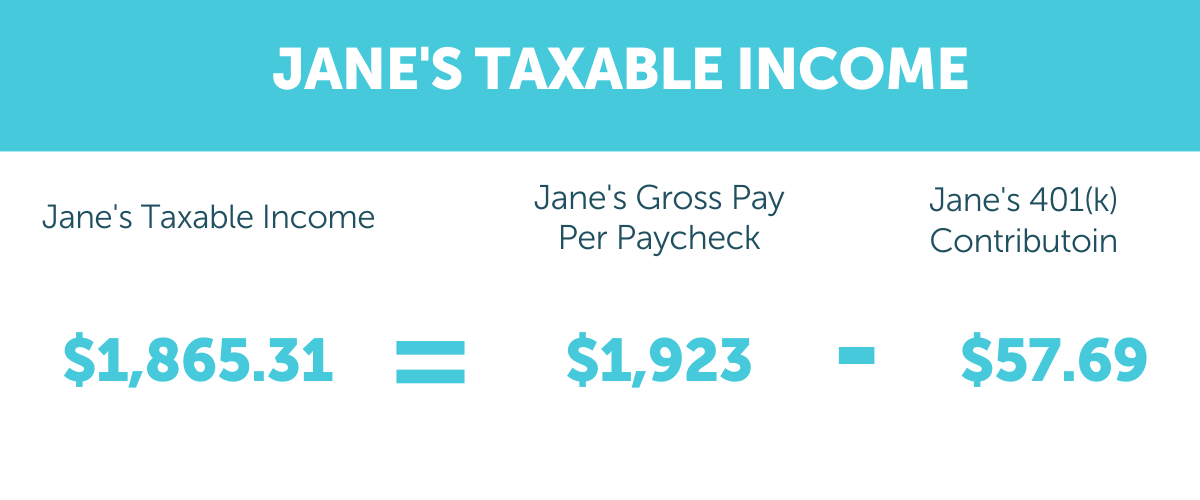

How Your Colorado Paycheck Works. Its important to note that there are limits to the pre-tax contribution amounts. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

Colorado residents who work in another state. In Denver youll pay 575 monthly if you make more than 500. These taxes go to the IRS to pay for your federal income taxes and FICA taxes.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Your total tax would be. If you are a Colorado resident your employer will withhold taxes from every paycheck you get.

In this case 453839475 gives you an effective tax rate of 115. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. Supports hourly salary income and multiple pay frequencies.

The Colorado Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Colorado State Income Tax Rates and Thresholds in 2022. Your total tax for 2020 is 4538. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and.

Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. While your marginal tax rate was 12 your effective tax rate or the average rate of tax you paid on your total income was lower. For annual and hourly wages.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. DENVER KDVR The Colorado Department of Revenue will be sending 24 million checks in early August to Coloradans who have filed out state tax returns. Select a tax type below to view the available payment options.

Colorado Salary Paycheck Calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado. Excise Fuel Tax.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. You are able to use our Colorado State Tax Calculator to calculate your total tax costs in the tax year 202223.

An employer that goes out of business dissolves or is. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Colorado. Colorado Hourly Paycheck Calculator.

For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. Check out our new page Tax Change to find out how federal or state tax changes. Details of the personal income tax rates used in the 2022 Colorado State Calculator are published below the.

For 2022 the Unemployment Insurance tax range is from 075 to 1039 with new employers generally starting at 17. Colorado Unemployment Insurance is complex. Your average tax rate is 1198 and your marginal tax rate is 22.

Switch to Colorado hourly calculator.

Calculating State Taxes And Take Home Pay Taxes Finance Capital Markets Khan Academy Youtube

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Here S How Much Money You Take Home From A 75 000 Salary

If You Re Self Employed You Re Still Eligible For The Paycheck Protection Program Here S How It Works Self Employment Paycheck Payroll Taxes

Printable Boarding Pass Card Instant Download Surprise Trip Etsy Surprise Trip Reveal Custom Travel Travel Tickets

Different Types Of Payroll Deductions Gusto

Pin On All Things Thrifty Frugal

Colorado State Taxes 2022 Tax Season Forbes Advisor

State Income Tax Rates Highest Lowest 2021 Changes

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Free Tax Prep Checklist Packet Mom For All Seasons Tax Prep Tax Prep Checklist Homeschool Freebies

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2022 Federal State Payroll Tax Rates For Employers

Free Online Paycheck Calculator Calculate Take Home Pay 2022

7 Paycheck Laws Your Boss Could Be Breaking Fortune

If You Re Self Employed You Re Still Eligible For The Paycheck Protection Program Here S How It Works Self Employment Paycheck Payroll Taxes

How To Do Payroll In Excel In 7 Steps Free Template

How To File Your Income Taxes For Free Or At Discount Filing Taxes Personal Finance Tax

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)